Swift Code Vs Iban : What Is A Swift Bic Code Pagofx / In practical terms, the swift code is a standard format of business identifier codes (bic), which are used by banks when transferring money between them.

Swift Code Vs Iban : What Is A Swift Bic Code Pagofx / In practical terms, the swift code is a standard format of business identifier codes (bic), which are used by banks when transferring money between them.. At present, banks in the us do not use the iban system. • iban is used by customers to send money abroad while swift is used by banks to exchange financial and non financial transactions. • iban allows for easier and faster money transfers worldwide. This information cannot be used to perform any other operation on your account. Iban and swift both are usually used in context to financial system.

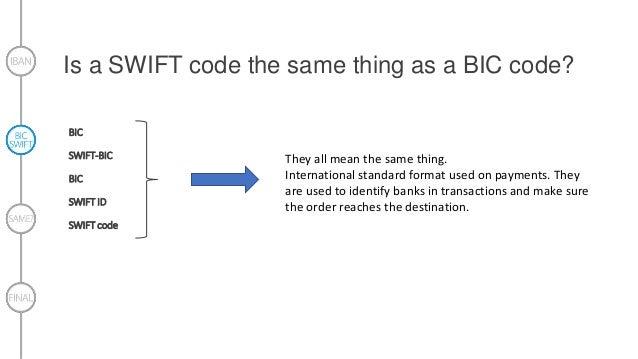

Read on for more information about each type of code. It allows a far rapid transfer of money across national borders. Iban code • swift code is for identification of a bank or business while iban is international bank account number. Swift stands for the society for worldwide interbank financial telecommunication, which provides a network that enables banks anywhere in the world to send and receive information in a standardised and secure environment. A swift code is used to identify a specific bank during an international transaction, whereas iban is used to identify an individual account involved in the international transaction.

It is a standard international numeric system created to identify overseas bank accounts.

Iban and swift both are usually used in context to financial system. What does a swift code look like? While swift codes are used for international transfers around the world, the iban is mostly used across europe, the middle east, north africa and the caribbean. Now let's talk about swift code. Iban code • swift code is for identification of a bank or business while iban is international bank account number. Both enable the quick, accurate transfer of funds overseas, although they aren't used by every country. Join over 10 million people who get the real exchange rate with wise. • iban allows for easier and faster money transfers worldwide. If you transfer money to someone who has a bank account in the united states, you will need to know either their bic/swift code or their aba routing number. In the eurozone, you'll always need an iban and a swift/bic code. It's the same in new zealand too. Home > blog > aba vs bic swift. Thus, an iban identifies the individual international account that a payment is heading to and a swift code denotes the financial institution that holds the account.

An example of an iban code in at great britain's national westminster bank is gb 29 nwbk 601613 31926819. Most countries however, have different fixed lengths. Iban and swift both are usually used in context to financial system. Banks in the united states do not provide iban format account numbers. The code is constructed using a bank or institution code, a country.

A swift code is used to identify a specific bank during an international transaction, whereas an iban is used to identify an individual account involved in the international transaction.

Home > blog > aba vs bic swift. Difference between bic (swift) and aba routing number. Similarly, your national bank code changes into swift code and will be used for transactions. • iban allows for easier and faster money transfers worldwide. While swift codes are used for international transfers around the world, the iban is mostly used across europe, the middle east, north africa and the caribbean. Swift code is helpful in providing network for banks to receive and send information in a secure and standardized environment while making transfer to a particular account. Banks in the usa use swift codes, but they don't use ibans. Iban stands for iban stands for international bank account number. Iban and swift both are usually used in context to financial system. These two things (iban+swift code) combine and complete the criteria of international online money transactions. Join over 10 million people who get the real exchange rate with wise. It is used as an identifier of an individual account for the international transactions. Both codes are made up in a very different way, and both codes do different jobs.

Both enable the quick, accurate transfer of funds overseas, although they aren't used by every country. Home > blog > aba vs bic swift. An internationa bank account number (iban) is a series of alphanumeric characters that uniquely identifies an account held predominantly by banks in eurozone. Swift stands for the society for worldwide interbank financial telecommunication, which provides a network that enables banks anywhere in the world to send and receive information in a standardised and secure environment. Unlike iban, which identifies specific bank accounts, swift refers to a specific bank only — including banks in the us.

Doesn't use iban at all.

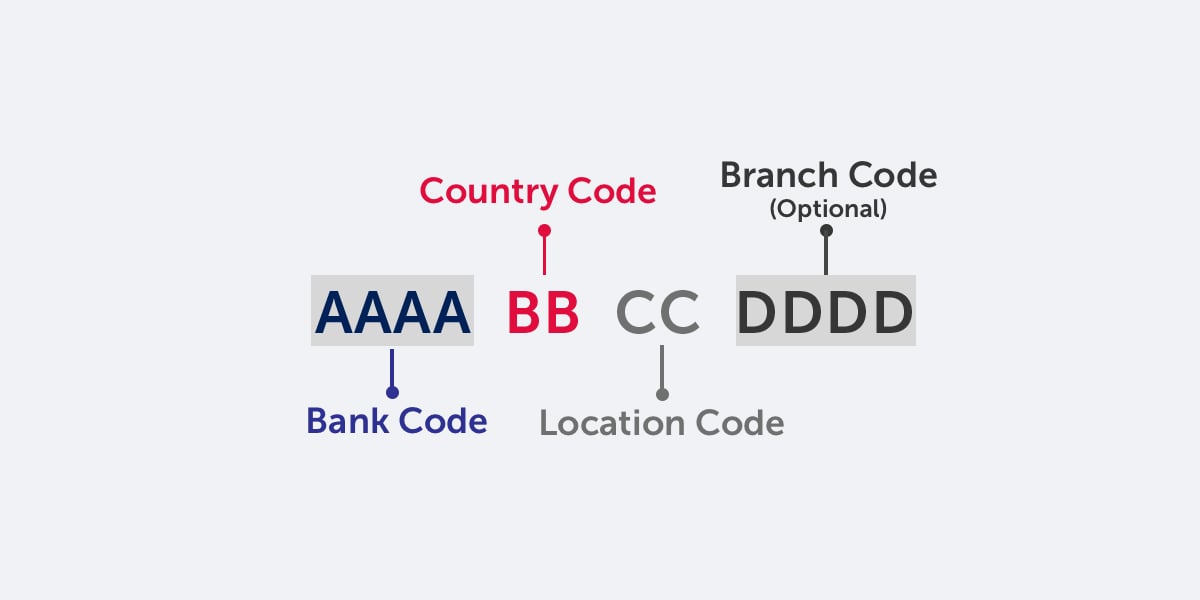

Similarly, your national bank code changes into swift code and will be used for transactions. It is a standard international numeric system created to identify overseas bank accounts. Orange county's credit union does not have an iban. The first two letters of the swift code refers the country code followed by a 2 digit location code and the last 3 digit code for the branch code. Swift stands for the society for worldwide interbank financial telecommunication, which provides a network that enables banks anywhere in the world to send and receive information in a standardised and secure environment. Bic (or swift) the bank identifier code (sometimes called swift) contains information about the receiving country, bank and branch. If you transfer money to someone who has a bank account in the united states, you will need to know either their bic/swift code or their aba routing number. The iban contains all necessary information of the owner if a bank account such as the account number, bank and branch information and country code. Unlike iban, which identifies specific bank accounts, swift refers to a specific bank only — including banks in the us. Bic, standing for bank identifier code, is just another name for swift code. Iban stands for international bank account number. Banks in the usa use swift codes, but they don't use ibans. This sequence of numbers and letters allows banks to identify the correct account when processing international payments.

Komentar

Posting Komentar